Expand Your Business

Our Initial Report service brings exceptional time savings to organizations in the process of forming or foreign qualifying their business. Our web-based ordering allows you to conveniently enter the required information just once. Fair, transparent pricing simplifies budgeting.

Don't waste time going back and forth with state offices. We've completed thousands of state filing projects correctly, and we are confident we can do the same for you.

Ultimate Convenience

-

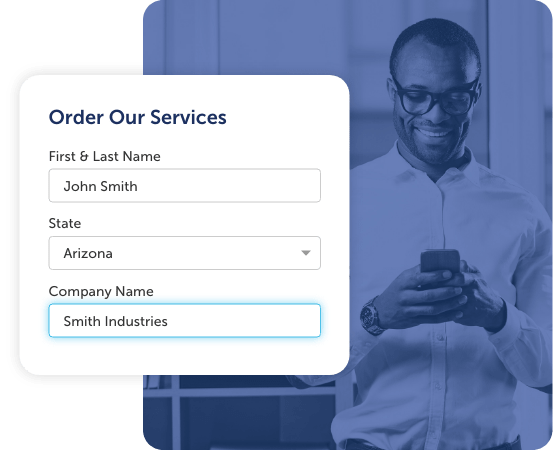

Instant Online Ordering

We make it easy to file your initial report. Simply provide your information in our convenient online form, and we'll take care of the rest. -

Fast Filing Speeds

Did you just learn about the initial report requirement and don’t have much time to file? We can provide priority service to complete your filing quickly. Select how fast you want to move when you place your order. -

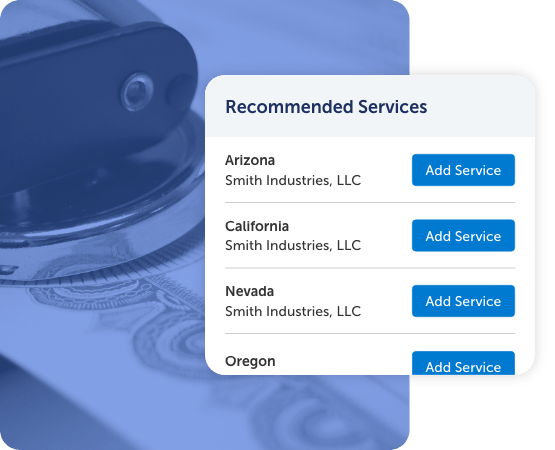

Service in Every State

Are you filing in multiple states? We routinely file initial reports for organizations across all 50 states, the District of Columbia, and Puerto Rico.

The Best Protection

-

Comprehensive Support

We can help you with any additional tax registrations or business licenses you may need. Our compliance services are a perfect fit for companies that plan to hire employees, sell physical goods, or open offices in other states. -

Proceed With Confidence

Harness the expertise of our filing experts through Compliance Gaps. As soon as your account is configured, Compliance Gaps suggests regulatory filings commonly required of companies like yours in the states where you operate.

How Our Initial Report Service Works

Complete the online form to order our initial report services. Once we have submitted your filings, we will track their progress and send confirmation when they are approved.

Filing Your Initial Report

We prepare and file your initial report.

Receive your approved initial report filing.

They walked us through the whole process step by step and remained in constant communication throughout. The level of service provided by our Account Manager and Compliance Specialist was beyond EXCELLENT. They were prompt, courteous, knowledgeable, and detailed… a truly STRESS FREE experience. You will not regret hiring Harbor Compliance!

Stephanie Loudoun Insurance Group, LLCFrequently Asked Questions

Initial reports are information updates due to the secretary of state after you form or register a business entity, such as an LLC, corporation, or nonprofit. Due dates vary by state but often fall within 90 days of registration.

Annual reports are entity information updates due to the secretary of state each year. After filing an initial report, LLCs, corporations, and nonprofits must file subsequent annual reports to maintain good standing.

Failure to file an initial report with a state in the required timeframe can result in government late fees and penalties such as losing good standing.

Currently, only a handful of states have initial report requirements, which makes them easy to overlook. These include Alaska, California, Connecticut, Georgia, Louisiana, Missouri, Nevada, New Mexico, South Carolina, and Washington.

Free Reference

Initial Report Requirements By StateReference this online guide for information on how to file initial reports in your state.