Tax Manager

Maintain Tax Registrations

- Track federal, state, and local tax registrations and exemptions

- Store payroll, sales, and corporate income tax accounts

- Readily access tax identification numbers and key information

Schedule a Demo

Reduce risks related to tax registration gaps and lapses

Drastically cut down staff time spent managing registrations

Equip your team with clarity on key tax account information

Ensure continuity through staff and vendor changes

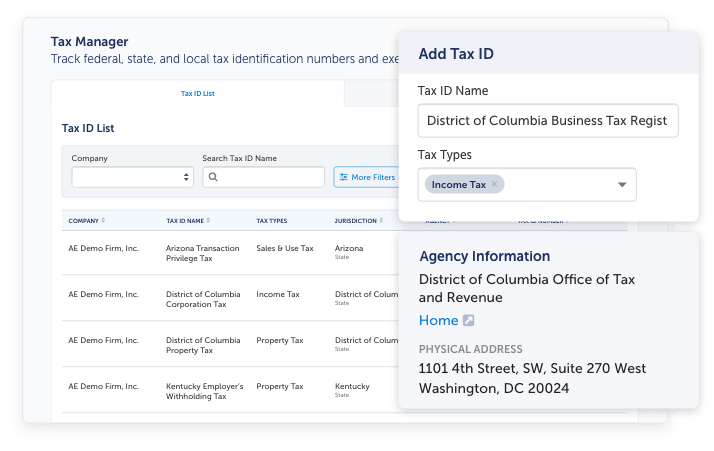

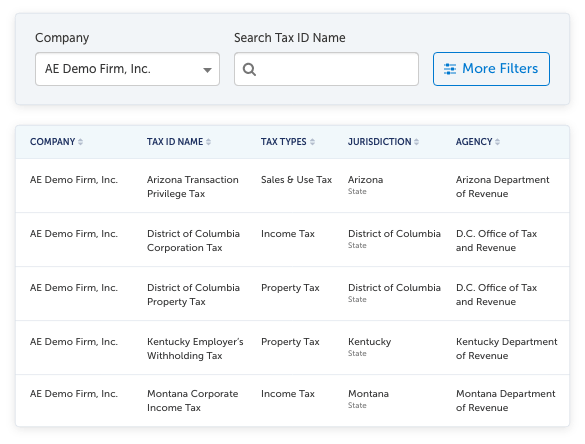

Tax ID List

View all of your tax registrations at a glance. Sort and filter the list as desired.

Looking up tax registrations is simple. Search by tax type, jurisdiction, agency, or other common attribute.

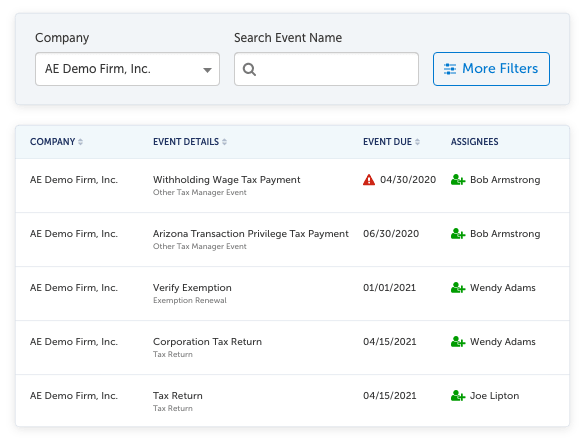

Event List

View upcoming events. See at a glance which individuals are assigned to receive automated notifications.

Tax ID Details

- Details - View details for each tax registration. Leverage Compliance Core™ data for agencies with quick links to forms and online accounts.

- Events - Set one-time or recurring events for tax return filings and other events. Assign individuals to receive automated reminders per the notification schedule you set.

- Structured storage - Store documents and time-stamped Notes on each Tax ID to stay organized.

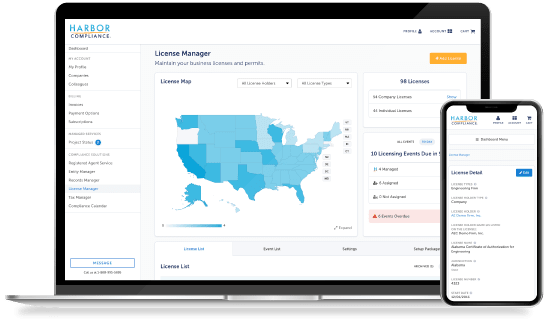

Explore the Power of the Harbor Compliance Suite

Streamlined compliance management for your business lifecycle, including entity, tax, records, and license management. Our unique SaaS-based compliance portfolio management platform is purpose-built for the needs of compliance professionals and administrative teams.

Experience new levels of confidence and efficiency with powerful data integrations, real-time status visualizations, carefully curated nationwide data repositories, and in-depth status and tracking features.

The Harbor Compliance Suite includes:

- Entity Manager

- License Manager

- Tax Manager

- Records Manager

- Requirements Research Engine

Request a Demo