Process Payroll in New States Without Delay

Open your payroll tax accounts so that you can hire employees in new states and process payroll timely. We complete your registration applications quickly and accurately so you can proceed without delays.

Ultimate Convenience

-

Remote Employers Rejoice

More employers are hiring remote workers than ever before. No matter how many states you hire employees in, we can complete the necessary payroll tax registrations to support your growing workforce. -

Multiple Tax Accounts, One Convenient Service

Some states require either a withholding account or an unemployment insurance account. Others require both. We open your tax accounts for withholding, unemployment insurance, or both as required by the state. -

Thought Your Payroll Processor Handled It?

Payroll processors rarely complete payroll tax registrations. More typically, they require their clients to provide payroll tax registration numbers and will only step in once the proper accounts have been opened. We can quickly establish your tax accounts so you can process payroll. -

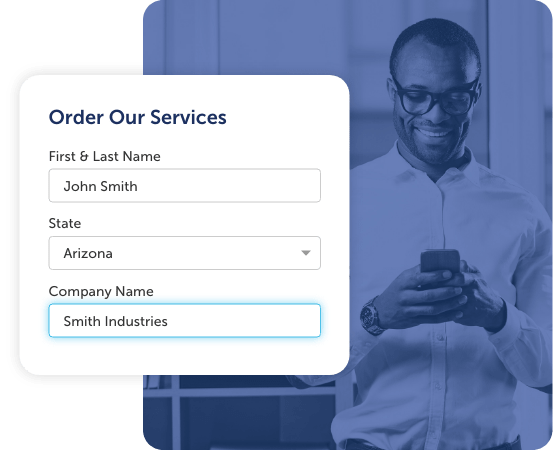

Instant Online Ordering

We make it easy to order our tax registration services. Simply provide your information in our convenient online form, and we’ll take care of the rest. -

Filing Speed Flexibility

Do you need to run payroll immediately? While states won’t always offer expedited options, we can move your project to the front of the line. Select how fast you want to move as you place your order.

The Best Protection

-

Proceed With Confidence

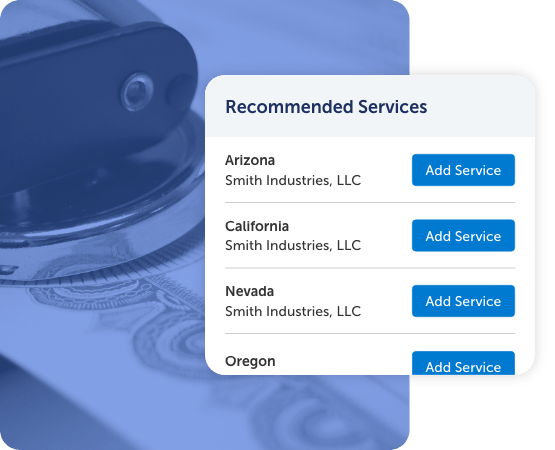

Harness the expertise of our filing experts through Compliance Gaps. As soon as your account is configured, Compliance Gaps suggests regulatory filings commonly required of companies like yours in the states where you operate. -

Comprehensive Support

We can help you with any additional tax registrations or business licenses you may need. Our compliance services are a perfect fit for companies that plan to hire employees, sell physical goods, or open offices in other states.

How Our Payroll Tax Registration Service Works

Complete the online form to order our payroll tax registration services. Once we have submitted your filings, you receive approval notices from the state.

Registering for Payroll Taxes

Provide basic information about your organization, including how fast you want to move.

Get StartedWe prepare and submit the required filings to open withholding and/or unemployment insurance accounts.

Receive your payroll tax identification numbers (IDs) directly from the state.

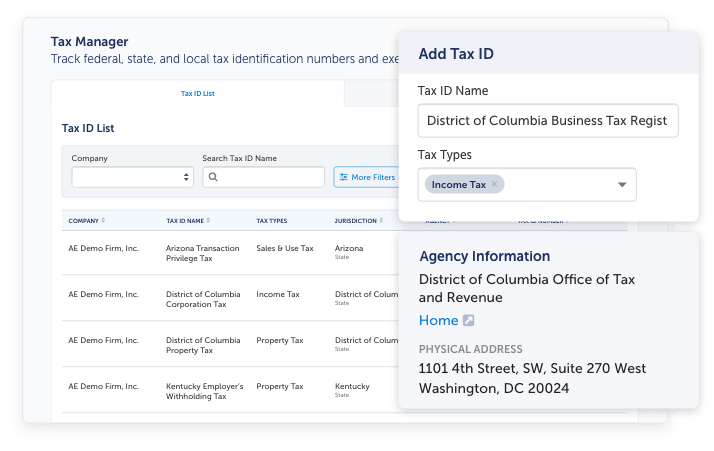

Tax Manager Software

Registering for payroll taxes generates new tax identification numbers that need to be securely stored for future reference by payroll and tax team members. Tax Manager is the dedicated home for all tax registration information. Registration numbers, agency contact information, related documents, and automated reminders of tax return filings and other events come standard.

Maintain Tax Registrations

- Track federal, state, and local tax registrations and exemptions

- Store payroll, sales, and corporate income tax accounts

- Readily access to tax identification numbers and key information

Harbor Compliance has been an asset to our business, assisting us with compliance and payroll tax registration to allow us to hire employees. They are a valued and responsive partner in helping our business grow! I would highly recommend their service!

John Box Cars and One-Eyed Jacks Inc.Frequently Asked Questions

In most states, the two payroll taxes are withholding and unemployment insurance (aka unemployment tax and unemployment compensation).

Employers must register for the appropriate payroll tax accounts in order to hire employees, process payroll, and file tax returns.

Foreign qualification and registered agent are prerequisites in most states.

Free Reference

Payroll Tax RegistrationThis user-friendly quick reference details payroll tax registration requirements in all 50 states.