Understand Your Sales Tax Obligations with Help from  LumaTax

LumaTax

Determining nexus and associated sales tax obligations can be challenging to navigate on your own. LumaTax can help. Their free assessment makes it easy to determine where you’ve most likely triggered physical and economic nexus.

- Answer seven simple questions to assess your risk

- Identify which states you may need to register for sales tax in

- Receive your LumaTax Compliance Score™ in minutes

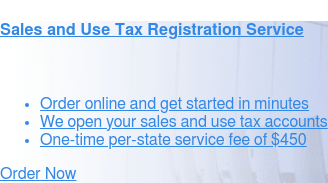

Easily Register for Sales and Use Tax

We open your sales and use tax accounts so that you can remit taxes in new states timely. Whether you track your tax obligations internally or outsource it to a tax calculation provider, we complete your registration applications quickly and accurately so you can proceed without delays.

Since the landmark Supreme Court case South Dakota vs. Wayfair, it’s more likely than ever that your business may be exposed to sales and use tax in multiple states. If you need help determining where your company may need to remit taxes, LumaTax’s free assessment can help.

Don’t wait for the states to come calling. Proactive registration allows you to avoid penalties before they arise.

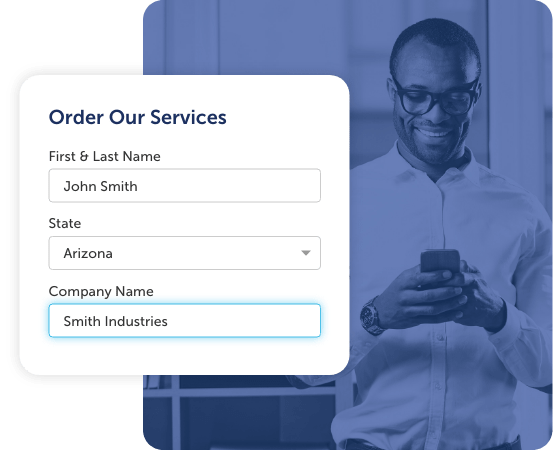

Ultimate Convenience

-

Instant Online Ordering

We make it easy to order our tax registration services. Simply provide your information in our convenient online form, and we’ll take care of the rest. -

Filing Speed Flexibility

Do you need your tax IDs quickly? While states won’t always offer expedited options, we can move your project to the front of the line. Select how fast you want to move as you place your order. -

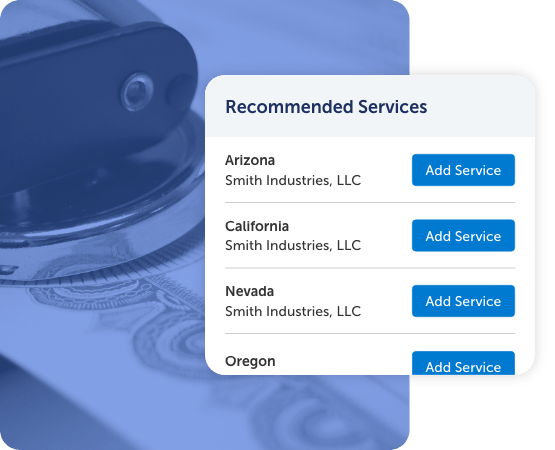

Service in Every State

No matter where your organization operates, we can obtain necessary sales and use tax permits so you can conduct business with confidence.

The Best Protection

-

Proceed With Confidence

Harness the expertise of our filing experts through Compliance Gaps. As soon as your account is configured, Compliance Gaps suggests regulatory filings commonly required of companies like yours in the states where you operate. -

Comprehensive Support

We can help you with any additional tax registrations or business licenses you may need. Our compliance services are a perfect fit for companies that plan to hire employees, sell physical goods, or open offices in other states.

How Our Sales and Use Tax Registration Service Works

Complete the online form to order our sales and use tax registration services. Once we have submitted your filings, you receive approval notices from the state.

Registering Your Organization for Sales and Use Taxes

Provide basic information about your company, including how fast you want to move.

Get StartedWe prepare and submit the required filings to register you for sales and use tax.

Receive your sales and use tax identification numbers (IDs) directly from the state.

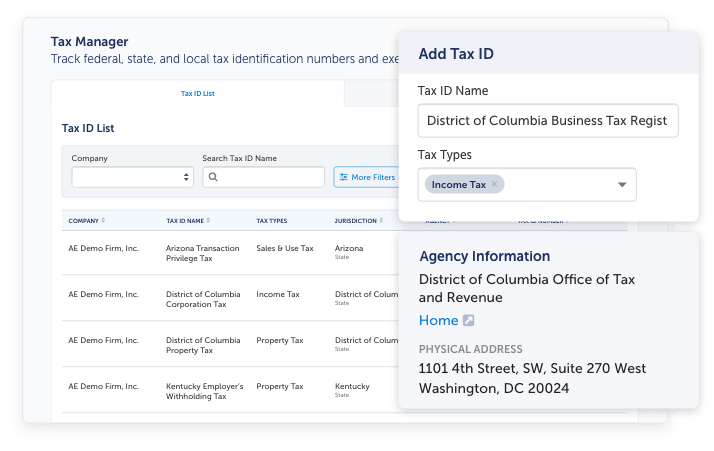

Tax Manager Software

Registering for sales and use taxes generates new tax identification numbers that need to be securely stored for future reference by accounting and tax team members. Tax Manager is the dedicated home for all tax registration information. Registration numbers, agency contact information, related documents, and automated reminders of tax return filings and other events come standard.

Maintain Tax Registrations

- Track federal, state, and local tax registrations and exemptions

- Store payroll, sales, and corporate income tax accounts

- Readily access to tax identification numbers and key information

They walked us through the whole process step by step and remained in constant communication throughout. The level of service provided by our Account Manager and Compliance Specialist was beyond EXCELLENT. They were prompt, courteous, knowledgeable, and detailed… a truly STRESS FREE experience. You will not regret hiring Harbor Compliance!

Stephanie Loudoun Insurance Group, LLCFrequently Asked Questions

Sales tax is a tax on the consumption of goods or services, most often levied on the final purchaser at the time of sale. Sales tax is not limited to retail sales. Services, leases, rentals, online sales, and other transactions may all be subject to sales tax. Sales tax can be levied simultaneously by state, county, and municipal agencies, so the final sales tax charged is the sum of these rates.

Use tax goes hand-in-hand with sales tax. Use tax is a consumption tax imposed on the purchaser for out-of-state goods used, consumed, or stored in the state. Use taxes are self-assessed by the purchaser. Typically applications for sales tax ids and use tax ids are consolidated into one form.

Nonprofits are not automatically exempt from sales and use tax. They may need to collect and remit sales tax on items they sell and pay sales and use tax, particularly on purchases of things not related to their tax-exempt purpose. Rules vary by jurisdiction and depend on the type of nonprofit and transaction. Organizations must comply with these rules.

Yes, potentially. Many states offer exemptions from sales and use tax for nonprofits as well as for-profit organizations operating in industries that enjoy specially-designated exemptions. In either case, sales and use tax exemptions generally involve complex filings and proof of exemption to be shown at point of sale.

Free Reference

Sales and Use Tax RegistrationThis user-friendly guide covers how to obtain tax ids, get exemption certificates, and maintain sales tax compliance in all 50 states.