Alabama Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Alabama Nonprofit & Fundraising Company Licenses

- Alabama Individual Nonprofit & Fundraising Licenses

Company Licenses

Alabama Nonprofit & Fundraising Company Licenses

Alabama Charitable Gaming License

Not required

Charitable Gaming licensure is not required on the State level in Alabama.

There is no state level licensing for games of chance in Alabama, however, many Alabama counties license charitable organizations for games of bingo.

Alabama Charitable Gift Annuity Registration

| Agency: | Alabama Securities Commission - Registration Division |

| Law: | AL Code § 8-6-10 and Securities Commission Administrative Code 830-X-6-.10 |

Initial Registration

| Form: | Form U-4: Uniform Application for Securities Industry Registration or Transfer |

| Agency Fee: | $60 per agent. |

| Notes: | Individual agents who solicit on behalf of an organization should register using form U-4. The issuing organization must also submit form U-2 and various supporting documents. |

Registration Renewal

| Agency Fee: | $60 |

| Due: | Annually |

A Charitable Organization is any benevolent, philanthropic, or patriotic person, or one purporting to be such, consistent with the then-controlling definition provided in the Internal Revenue Code of the United States of America, which solicits and collects funds for charitable purposes and includes each local, county, or area division within this state of the charitable organization; provided the local, county, or area division has authority and discretion to disburse funds or property otherwise than by transfer to any parent organization.

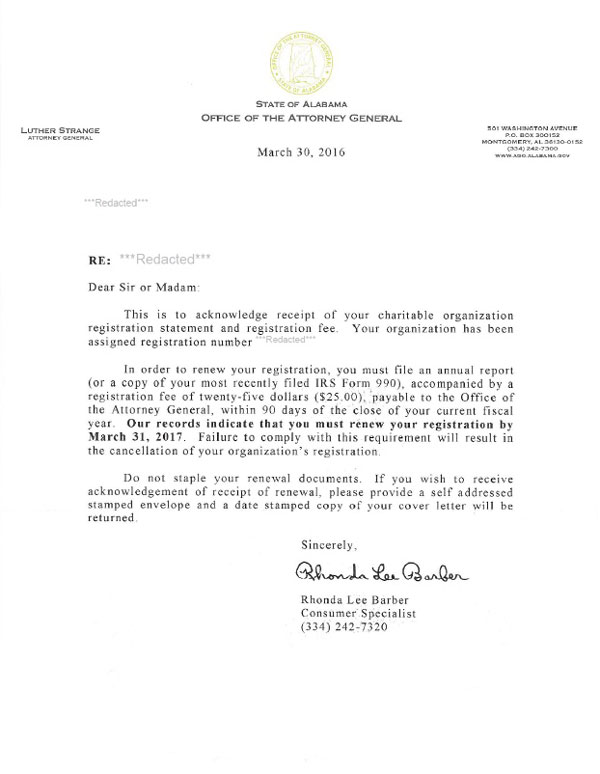

Alabama Charitable Organization Registration

| Agency: | Alabama Attorney General - Consumer Interest Division |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

One-Time Exemption Registration

| Exemption Eligible Organizations: |

|

| Filing Method: | |

| Agency Fee: | $0 |

| Law: | |

| Notes: | Exemptions do not expire as long as the organization continues to qualify under the exemption criteria. |

Initial Registration

| Form: | |

| Filing Method: | |

| Agency Fee: | $25 |

| Turnaround: | 2-3 weeks |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Notes: |

|

| Before you Apply: | All Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | |

| Agency Fee: | $25 |

| Due: |

|

| Due Date Extension: | Due dates can be extended for 180 days beyond the original due date by submitting a request for extension through the online portal. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Penalties: | There are no late fees if a charity does not renew its registration. The Attorney General will mail the organization a 15-day notice of registration cancellation. The organization will have that period to cease solicitation and if the solicitation is ceased, then no penalties apply. |

| Notes: | One authorized officer must sign the renewal. Alabama does not require a specific title. |

| Required Attachments: |

|

Amendment

| Filing Method: | |

| Agency Fee: | $0 |

| Due: | The organization must notify the Attorney General within 10 days of any change in the information required for registration. |

Reinstatement

Not required

Formal reinstatement is not required. Charities who wish to renew a lapsed registration should submit a renewal filing along with the required financials, attachments, and fee(s) for each year not registered.

Change of Fiscal Year

| Filing Method: | Email to consumerinterest@alabamaag.gov |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Notes: | To update your fiscal year submit a letter to the Attorney General's office requesting the change. Make sure to include the full name of the charity and either the Alabama License number or your organization's FEIN. |

Cancelation

| Form: | |

| Filing Method: | |

| Agency Fee: | $0 |

| Notes: | To close out your registration, submit a notice of non-renewal on the state's portal. It will require a reason for withdrawal and the date that solicitations will be discontinued. |

A Commercial Co-Venturer is any person who for profit or other commercial consideration conducts, promotes, underwrites, arranges, or sponsors a sale, performance, or event of any kind which is advertised, and which will benefit, to any extent, a charitable or religious organization. However, any such person who will benefit in good will only is not a commercial co-venturer if the collection and distribution of the proceeds of the sale, performance, or event are supervised and controlled by the benefiting charitable or religious organization.

Alabama Commercial Co-Venturer Registration

Initial Registration

| Filing Method: | |

| Agency Fee: | $100 |

| Turnaround: | 2-3 business days |

| Bond Amount: | $10,000 |

Registration Renewal

| Filing Method: | |

| Agency Fee: | $100 |

| Turnaround: | 1-3 business days |

| Due: | Annually by September 30. |

| Bond Amount: | $10,000 |

Contract Filing

| Filing Method: | |

| Agency Fee: | $0 |

| Due: | File a copy of all contracts entered into with charitable organizations within 10 days after the beginning of the contract. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Notes: | The charity must be registered to solicit charitable contributions or otherwise exempt for the contract to be accepted. |

Contract Amendment

| Filing Method: | |

| Agency Fee: | $0 |

| Notes: | Changes to a filed contract should be made using the online system. |

Financial Reporting

| Filing Method: | |

| Agency Fee: | $0 |

| Due: | CCVs must file a closing statement within 90 days of the termination of a contract with a charitable organization. |

Professional Fund Raisers plan, conduct, manage, or carry-on a drive or campaign for the purposes of soliciting charitable contributions in this state.

Alabama Professional Fundraiser Registration

| Agency: | Alabama Attorney General - Consumer Interest Division |

| Law: | |

| Bond Requirements: | $10,000 |

Initial Registration

| Filing Method: | |

| Agency Fee: | $100 |

| Original Ink: | Not required |

| Notarization Required?: | Required |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | |

| Agency Fee: | $100 |

| Due: | Annually by September 30. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

Contract Filing

| Agency Fee: | $0 |

| Due: | File a copy of all contracts entered into with charitable organizations within 10 days after the beginning of the contract. |

| Law: |

Financial Reporting

| Filing Method: | |

| Agency Fee: | $0 |

| Due: | File a closing statement form within 90 days after the close of charitable organization contracts. |

Individual Licenses

Alabama Individual Nonprofit & Fundraising Licenses

A Professional Solicitor is any person who is employed or retained for compensation by a professional fund raiser to solicit contributions for charitable purposes in this state.

Alabama Professional Solicitor Registration

| Agency: | Alabama Attorney General - Consumer Interest Division |

Initial Registration

| Form: | |

| Agency Fee: | $25 |

| Original Ink: | Not required |

| Notarization Required?: | Required |

Registration Renewal

| Form: | |

| Agency Fee: | $25 |

| Due: | Annually by September 30. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |