Online Fundraising & The Charleston Principles

- Definition - The Charleston Principles

- An effort by the National Association of State Charity Officials (NASCO) to provide jurisdictions with guidelines on how to regulate online solicitors. Released in 2001, they provide broad guidance for states, but a minority of jurisdictions follow them. Additionally, they have never been ratified into law. Disclaimer: We’re mentioning the Charleston Principles here in order to be as comprehensive as possible. However, it’s important to note that, by admission of their author, these guidelines are an academic exercise. To decide whether or not to register in a given jurisdiction, ask yourself, “Am I giving residents the opportunity to donate?” If the answer is yes and the jurisdiction has a registration requirement, you’ll likely need to file a registration application.

- Definition - Donor Advised Fund

- A private fund administered by a third party, often an investment brokerage firm, created to manage charitable donations on behalf of an organization, family, or individual. Donors to the fund can immediately receive the tax benefits of charitable giving and can direct the fund to disperse their donation to charities of their choosing.

Before you publish a “Donate” button on your website, launch a multi-state email campaign, or use social media to solicit donations, your organization may first need to register for charitable solicitation.

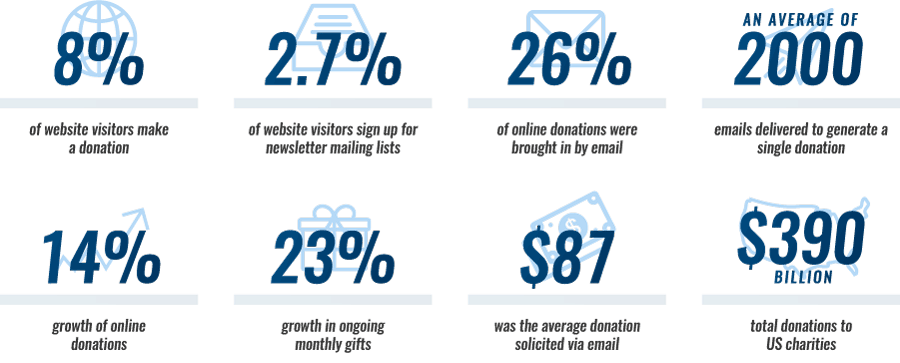

Online fundraising is everywhere. Organizations that raise funds without using the internet in some way are becoming rarer and rarer. Many organizations accept donations on their websites using a “Donate” button. In addition, charities commonly make solicitations by email, including asking for donations in their email newsletters. Social media is yet another form of solicitation. While very common, these methods of solicitation can pose unique regulatory challenges for organizations that employ them.

Nationwide Solicitation Means Nationwide Registration

Fundraising online is generally considered soliciting nationwide, since “Donate” sections on charity websites, emails to newsletter subscribers, and social media are all solicitations that can reach citizens of every state. When charities receive donations because of those solicitations and then follow up with those donors to ask for additional donations, either by email or any other method, those charities are then furthering their charitable solicitation activities.

Most jurisdictions do not have special laws for soliciting donations online but rather categorize these methods under "other media." The requirements are different in every jurisdiction (see the navigation to the right for each jurisdiction's requirements). On top of that, the laws, forms, and procedures are constantly changing. As a result, charities that solicit using these methods would generally need to register in all jurisdictions where requirements exist.

To ensure 100 percent compliance, organizations that solicit online file an exemption everywhere they are eligible and register for charitable solicitation in all other states with requirements. This is the best option for groups that intend to fundraise nationwide by any method.

Targeted registration

Of course, not all organizations have the resources to register everywhere. Budgetary constraints are a common challenge, particularly for very small charities. For these organizations, a more measured approach may be best. Organizations with smaller fundraising footprints that still wish to solicit donations online can contain their risk by clearly stating which jurisdictions they’ll be accepting donations from. In practice, the organization places language on its website explaining that it does not accept donations from states where it is not registered.

Top 5 Tips

As you prepare to solicit donations online:

- Always register in your jurisdiction of incorporation.

- Following up with a donor that initially contributed via your website will trigger registration requirements in the jurisdiction where they are located. Conventional methods of solicitation will always trigger registration requirements even if the donor’s first contribution came through your website. Remember, email is generally treated the same as a mail or in-person solicitation.

- Soliciting strictly through a charity portal that’s backed by a donor-advised fund does not trigger registration. Network For Good and Amazonsmile are common examples. Technically the donation is given to the fund as the payee. Scrutinize any website before assuming it is a donor-advised fund; their fine print may pass the burden of charitable registration on to you.

- Online solicitation occurs anytime you provide the means to contribute to your organization. A non-interactive website that encourages donations through third-party sites or offline means will still trigger registration. It is not a loophole.

- You can use social media to send out information about your organization’s activities without needing to register. However, when your language invites solicitation, you do need to register. A fan promoting donations independent of the nonprofit does not trigger registration. (Please note, California will require charitable solicitation registration within 30 days of receiving a donation, regardless of whether the donation was solicited.)