South Carolina Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- South Carolina Nonprofit & Fundraising Company Licenses

- South Carolina Individual Nonprofit & Fundraising Licenses

Company Licenses

South Carolina Nonprofit & Fundraising Company Licenses

South Carolina Bingo License

Initial Registration

| Agency: | South Carolina Department of Revenue - Bingo Licensing and Enforcement Unit |

| Form: | Form L-2058: Application for Bingo License Nonprofit Organization |

| Agency Fee: | $4,000 for Class AA license, $1,000 for Class B license, $0 for Class C license, $100 for no more than 10 days or $200 for more than 10 days for Class D license, $500 for Class E license, $100 for Class F license. |

South Carolina Charitable Gift Annuity Registration

Not required

Charitable Gift Annuity licensure is not required on the State level in South Carolina.

No filing is required, but charities need to meet certain conditions before issuing charitable gift annuities. South Carolina exempts charitable, religious, benevolent, and educational organizations from insurance laws related to charitable gift annuities as long as they have been in existence for at least 5 years. For-profit entities, including nursing homes, are not exempt.

| Law: | SC Code § 38-5-20 |

South Carolina Charitable Organization Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | Yes |

Automatic Exemption

| Exemption Eligible Organizations: |

|

| Notes: | Religious organizations and political candidates and groups are automatically exempt from registration. |

Registration to Obtain Exemption

| Exemption Eligible Organizations: | Organizations that do not use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit and meet one of the following criteria:

Also, organizations that meet one one of the following criteria regardless of whether or not they use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit:

|

| Form: | |

| Agency Fee: | $0 |

| Law: |

Renewal to Maintain Exemption

| Exemption Eligible Organizations: | Organizations that do not use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit and meet one of the following criteria:

Also, organizations that meet one one of the following criteria regardless of whether or not they use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit:

|

| Form: | |

| Agency Fee: | $0 |

| Due: | Annually by the 15th day of the 5th month following the close of your fiscal year. |

Initial Registration

| Form: | |

| Filing Method: | Online or mail. |

| Agency Fee: | $50 + $1.85 online filing fee. |

| Turnaround: | 1 week |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

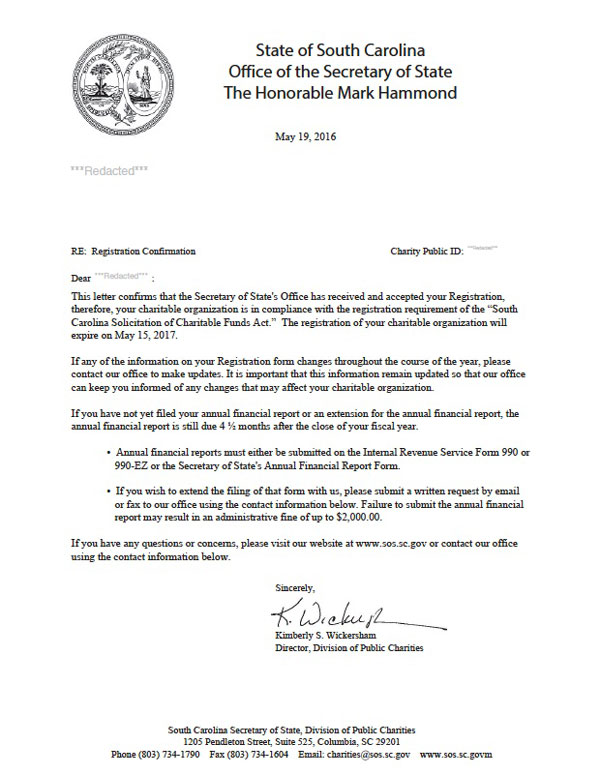

Registration Renewal

Annual Registration Statement

| Form: | Registration Statement for a Charitable Organization (Renewal) |

| Filing Method: | Online or mail. |

| Agency Fee: | $50 + $1.85 online filing fee. |

| Due: | Annually by the 15th day of the 5th month following the close of your fiscal year. So if your fiscal year ends December 31, then file by May 15. |

| Due Date Extension: | The registration statement renewal cannot be extended. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Penalties: | $10 per day per delinquent report (max $2,000 per report) |

| Notes: |

|

| Required Attachments: |

|

Registration Renewal

Annual Financial Report

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Annually by the 15th day of the 5th month following the close of your fiscal year. So if your fiscal year ends December 31, then file by May 15. |

| Due Date Extension: | The due date for the annual financial statement can be extended for 6 months beyond the original due date by emailing the department at charities@sos.sc.gov with your request. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Penalties: | $10 per day per delinquent report (max $2,000 per report) |

| Notes: | Organizations who do not file by the due date will receive a notice by certified mail giving them 15 days to submit the required renewal before late fees begin to accrue. |

| Required Attachments: | None |

Contract Filing

| Form: | |

| Filing Method: | |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and commercial coventurers must disclose the following, if applicable:

|

Reinstatement

Not required

Formal reinstatement is not required. Charities wishing to renew a lapsed registration should submit a renewal filing (registration statement and/or annual financial report) with payment of applicable fees (renewal + late fees). Organizations that have been out of compliance for an extended time should reach out to the Division directly for a detailed list of what they need to supply.

Change of Fiscal Year

| Filing Method: | Email charities@sos.sc.gov to update fiscal year. |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Notes: | Your fiscal year can be updated by emailing the secretary of state with notice of this change. Make sure to include the full name of the organization and charity registration ID. |

Cancelation

| Filing Method: | Email charities@sos.sc.gov |

| Agency Fee: | $0 |

| Notes: | To withdraw a registration you must email and termination request letter and make sure all annual financial reports are up to date to the last day of solicitations in South Carolina. |

Commercial co-venturer means a person that regularly and primarily engages in trade or commerce for profit that, for the benefit of a charitable organization, may raise funds by advertising that the purchase or use of goods, services, entertainment, or other thing of value benefits the charitable organization, if it is offered at a price comparable to similar goods or services in the market.

South Carolina Commercial Co-Venturer Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: |

Initial Registration

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $50 |

| Turnaround: | 1-2 business days |

| Bond Amount: | None |

| Background Check Requirements: | ACCESS PREMIUM DATA |

Registration Renewal

| Form: | Registration Application for a Commercial Co-Venturer (Renewal) |

| Filing Method: | Mail or online. |

| Agency Fee: | $50 |

| Due: | Annually |

| Bond Amount: | None |

Contract Filing

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and commercial coventurers must disclose the following, if applicable:

|

| How to Apply: | The charity must be registered to solicit charitable contributions or otherwise exempt for the contract to be accepted. |

Contract Amendment

| Agency Fee: | $0 |

| Due: | An amendment filing should be made before the expiration date of a campaign in order to extend the campaign. |

| Notes: | To report an extension of a campaign or another change to a campaign agreement, submit a cover letter describing the change and include a copy of the amended agreement. |

Financial Reporting

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and within 90 days after the anniversary of commencement for campaigns lasting more than a year. |

| Penalties: | South Carolina enforces very strict fines on joint financial reports that are not filed within 90 days of the conclusion of the campaign. |

Professional fundraising counsel means a person that for a fixed rate of compensation plans, conducts, manages, prepares materials for, advises, or acts as a consultant, directly or indirectly, in connection with soliciting contributions for or on behalf of a charitable organization, but that actually does not solicit, receive, or collect contributions as a part of these services. A person whose compensation is computed on the basis of funds actually raised or to be raised is not a professional fundraising counsel pursuant to the provisions of this chapter. A bona fide salaried officer or employee of a charitable organization maintaining a permanent establishment within this State, or the bona fide salaried officer or employee of a parent organization certified as tax exempt, is not a professional fundraising counsel.

South Carolina Professional Fundraising Counsel Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: | |

| Registered Agent (Special Agency) Required? | Yes |

Initial Registration

| Form: | Registration Application for a Professional Fundraising Counsel |

| Agency Fee: | $50 |

Registration Renewal

| Form: | Registration Application for a Professional Fundraising Counsel (Renewal) |

| Agency Fee: | $50 |

| Due: | Annually |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and professional fundraising counsel must disclose the following, if applicable:

|

Professional solicitor means a person that, for monetary or other consideration, solicits contributions for or on behalf of a charitable organization, either personally or through its agents, servants, or employees or through agents, servants, or employees who are specially employed by or for a charitable organization, who are engaged in the solicitation of contributions under the direction of that person. "Professional solicitor" also means a person that plans, conducts, manages, carries on, advises, or acts as a consultant to a charitable organization in connection with the solicitation of contributions but does not qualify as "professional fundraising counsel" within the meaning of this chapter. A bona fide salaried officer, unpaid director, a bona fide employee of a charitable organization, or a part-time student employee of an educational institution is not a professional solicitor. A paid director or employee of a charitable organization is not a professional solicitor unless his salary or other compensation is paid as a commission computed on the basis of funds actually raised or to be raised.

South Carolina Professional Fundraising Solicitor Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: | |

| Bond Requirements: | $15,000 |

Initial Registration

| Form: | |

| Agency Fee: | $50 |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Notes: |

|

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Form: | Registration Application for a Professional Solicitor (Renewal) |

| Agency Fee: | $50 |

| Due: | Annually |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and professional solicitors must disclose the following, if applicable:

|

Financial Reporting

| Form: | |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and within 90 days after the anniversary of commencement for campaigns lasting more than a year. |

Individual Licenses

South Carolina Individual Nonprofit & Fundraising Licenses

South Carolina Individual Professional Solicitor Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

Initial Registration

| Form: | Registration Application for an Individual Professional Solicitor |

| Agency Fee: | $50 |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

Registration Renewal

| Form: | Registration Application for an Individual Professional Solicitor (Renewal) |

| Agency Fee: | $50 |

| Due: | Annually |

| Original Ink: | Not required |

| Notarization Required?: | Not required |