Kansas Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Kansas Nonprofit & Fundraising Company Licenses

- Kansas Individual Nonprofit & Fundraising Licenses

Company Licenses

Kansas Nonprofit & Fundraising Company Licenses

Kansas Bingo License

| Game Type: | Bingo |

| Agency: | Kansas Department of Revenue - Division of Taxation |

| Age Restrictions: | Pull-tab game participants must be at least 18 years old. There is no age limit for call bingo. |

Kansas Charitable Gift Annuity Registration

Not required

Charitable Gift Annuity licensure is not required on the State level in Kansas.

No filing is required, but charities need to meet certain conditions before issuing charitable gift annuities. Kansas generally exempts organizations with a religious, educational, benevolent, fraternal, charitable, social, athletic, or reformatory purpose from insurance regulations related to charitable gift annuities.

| Law: | K.S.A. § 17-12a201(7) |

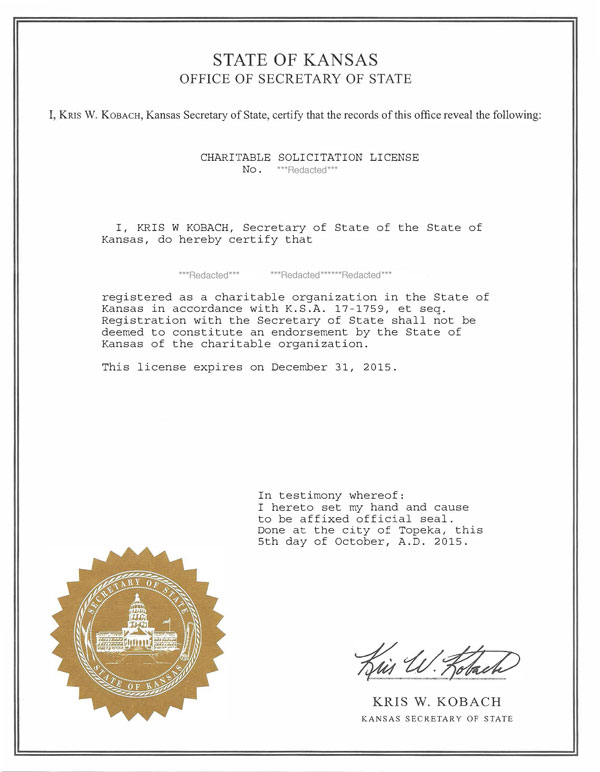

Kansas Charitable Organization Registration

| Agency: | Kansas Attorney General - Consumer Protection Division - Charitable Organization Registration Unit |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

Automatic Exemption

| Exemption Eligible Organizations: |

|

| Law: |

Initial Registration

| Form: | |

| Filing Method: | |

| Agency Fee: | $25 |

| Turnaround: | 4-6 weeks |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Filing Method: | |

| Agency Fee: | $25 |

| Due: |

|

| Due Date Extension: | Kansas does not allow for late registrations even if the IRS extends a federal tax deadline; however, Kansas does not charge an additional fee for late registration. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Notes: | The CFO and another authorized officer must sign. They must be two individuals. Notarization of signatures is not needed. |

| Required Attachments: |

|

Reinstatement

Not required

Formal Reinstatement is not required. Charities who wish to renew an expired registration should submit a renewal filing with the most recent and complete financial information. Organizations will only pay one renewal fee.

Change of Fiscal Year

| Form: | Charitable Organization Registration (Change of Fiscal Year) |

| Agency Fee: | $0 |

| Notes: | Fiscal year can be changed during the standard renewal process. |

Cancelation

| Notes: | Kansas allows charities to simply let their registration expire but highly encourages a letter for the record stating that they wish to withdraw and are no longer soliciting. If soliciting took place in a partial fiscal year, the organization must file a final renewal. |

Kansas Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Kansas.

Kansas does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

“Professional fundraiser” means any person, who is retained under contract or otherwise compensated by or on behalf of a charitable organization primarily for the purpose of soliciting funds. A professional fundraiser includes a person who plans, manages, advises, consults, or prepares material for solicitations.

Professional fundraiser shall not include any bona fide employee of a charitable organization who receives regular compensation and is not primarily employed for the purpose of soliciting funds, or an attorney, investment counselor, or banker who in the conduct of such profession advises a client to make a contribution

Kansas Professional Fundraiser Registration

| Agency: | Kansas Attorney General - Consumer Protection Division - Charitable Organization Registration Unit |

| Law: |

Initial Registration

| Form: | |

| Agency Fee: | $25 |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Agency Fee: | $25 |

| Due: | Annually by June 30. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | An operating statement must be filed before acting as a professional fund raiser for a charitable organization. |

Financial Reporting

Professional Fund Raiser Annual Report

| Form: | |

| Agency Fee: | $0 |

| Due: | Annually by July 31. |

Kansas Raffle License

| Game Type: | Raffles |

| Agency: | Kansas Department of Revenue - Division of Taxation |

Initial Registration

Registration Renewal

Individual Licenses

Kansas Individual Nonprofit & Fundraising Licenses

Kansas Professional Solicitor Registration

| Agency: | Kansas Attorney General - Consumer Protection Division - Charitable Organization Registration Unit |

Initial Registration

| Form: | |

| Agency Fee: | $25 |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

Registration Renewal

| Form: | |

| Agency Fee: | $25 |

| Due: | Annually by June 30. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |